(Note - all views are those of Fintech Compliance Chronicles/my personal views and not affiliated with any other organization)

Housekeeping/Promotional Message - Are you attending Fintech Meetup? If you are, please contact me! I am putting together a Fintech Compliance dinner for folks in the space during the event, and want to gauge your interest, or even better, discuss co-sponsoring the event.

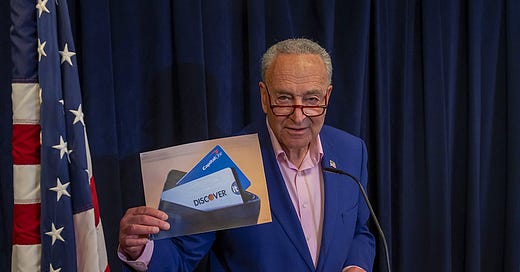

We interrupt our 2025 preview series to bring a special edition of Fintech Compliance Chronicles. It’s almost a year to the date from when the news of Capital One seeking to acquire Discover was announced, and yesterday’s shareholder vote marks a significant milestone in this financial saga. Let’s unpack the vote and understand the implications from a regulatory compliance lens.

Shareholder Approval: A Resounding “Yes”

The numbers speak volumes. At Capital One’s Special Meeting, an overwhelming 99.8% of voted shares supported the deal, representing 85.1% of total outstanding shares as of December 27, 2024. On Discover’s side, the enthusiasm was equally palpable, with over 99.3% of voted shares favoring the transaction, accounting for approximately 81.6% of outstanding shares.

This near-unanimous approval from shareholders on both sides is a major, albeit wholly unsurprising, vote of confidence in the merger. These figures represent a huge portion of each company’s total outstanding shares, indicating strong engagement from shareholders. I will point out these numbers are quite high - for comparison, a recent merger of two regional banks in Ohio only received approval from 85 and 65 percent of their respective shareholders.

Regulatory Hurdles: The Road Ahead

While shareholder approval is a crucial step, it’s just one piece of the puzzle. As we’ve discussed in our previous articles, the regulatory landscape looms large over this deal. Capital One anticipates closing the transaction in early 2025, subject to approval from the Board of Governors of the Federal Reserve System and the Office of the Comptroller of the Currency, along with other customary closing conditions.

Remember when we talked about the potential regulatory challenges? Well, they’re still very much in play. Capital One will need to play nice with the DOJ on this deal, which becomes much easier given the change to a more business-friendly Trump administration.

Compliance Considerations

Let’s revisit some of the key compliance aspects we’ve discussed previously and see how they might be affected by this vote:

Network Integration and Compliance

The overwhelming shareholder support might accelerate plans for integrating Discover’s network into Capital One’s operations. This could potentially lead to faster implementation of compliance measures across the combined network infrastructure. However, it also means that regulators will be watching closely to ensure that this integration doesn’t create new compliance risks or exacerbate existing ones.

Deposits and Banking Services

With shareholders giving their blessing, we might see quicker movement on integrating Discover’s deposits business with Capital One’s existing services. This could lead to new compliance challenges, especially if they decide to expand their physical presence or venture more aggressively into business banking, as we speculated earlier.

Fraud and Risk Management

The shareholder approval doesn’t directly affect the fraud and risk management strategies, but it does set the stage for potentially faster integration of these crucial compliance functions. Capital One will need to ensure that any changes or consolidations in these areas meet or exceed current regulatory standards.

The Regulatory Approval Process

While shareholders have given their enthusiastic support, the real test lies ahead with regulatory bodies. The extension of the merger agreement’s termination date to May 19, 2025, gives some breathing room, but also indicates the complex nature of the regulatory approval process.

It’s worth noting that the Office of the Delaware State Bank Commissioner has already given its nod to the deal back in December 2024. However, the big players - the Federal Reserve and the OCC - are yet to weigh in.

The political landscape adds another layer of complexity. With the potential shift in regulatory stance under the current administration, there’s speculation about a possibly less rigid approach to bank mergers. However, this doesn’t mean it’s smooth sailing from here. The size and market impact of this deal ensure it will face rigorous scrutiny.

Implications for Customers and Employees

While the shareholder vote doesn’t directly address the concerns we raised about potential impacts on customers and employees, it does set the wheels in motion for the next phases of the merger. The overwhelming support from shareholders might embolden the leadership to move more decisively on integration plans, which could accelerate any potential changes to product offerings, customer service structures, or employment situations.

Discover's Financial Restatement: A Bump in the Road

We didn’t cover it as it happened (I blame the travel and year-end business for that) but Discover's financial restatement stemming from its now-notorious card misclassification issue was a textbook example of the kind of compliance concern that can complicate even the most strategically sound deals.

The Background

In late 2024, Discover Financial Services found itself in hot water with the Securities and Exchange Commission (SEC) over a significant accounting error. The aforementioned misclassification issue led to a substantial understatement of liabilities. Initially, Discover had recognized a liability of $365 million related to this issue. However, after review and discussions with the SEC, this figure ballooned to a whopping $1.2 billion.

The implications were far-reaching:

Discover had to restate its financial statements for 2022, 2023, and parts of 2024.

The restatement involved reallocating $600 million from other expenses to a revenue error correction in prior periods.

An additional $124 million in interest payments had to be reallocated to the third and fourth quarters of 2023.

The company's assets increased by $190 million, accrued expenses and other liabilities jumped by $783 million, and retained earnings decreased by $593 million as of December 31, 2023.

The impact of this caused delays in business-as-usual filings; the New York Stock Exchange (NYSE) issued a non-compliance notice to Discover for failing to timely file its quarterly report for Q3 2024.

Impact on the Merger Process

Now, you might be wondering, "How does this affect the Capital One deal?" Well, it's not just about the numbers; it's about trust, regulatory scrutiny, and timing.

Regulatory Scrutiny: This kind of financial restatement inevitably attracts additional regulatory attention. The Fed and OCC, already eyeing this deal closely, now have another reason to put everything under the microscope.

Timing Delays: The need to restate financials pushed back several key steps in the merger process. Capital One couldn't file its pre-effective amendment to the Registration Statement until Discover got its financial house in order.

Shareholder Confidence: While shareholders have now approved the deal, the restatement could have shaken investor confidence. It's a testament to the perceived value of the merger that approval remained strong despite this hiccup.

Compliance Concerns: This incident highlights the importance of robust compliance and accounting practices. You can bet that regulators will be looking closely at how the combined entity plans to manage these risks going forward.

The Silver Lining

Believe it or not, there's a positive spin to this story. Discover managed to file its restated financials before the end of 2024, as promised. Literally the same day, Capital One filed the pre-effective amendment, demonstrating how critical fixing this was to the deal being able to continue to move forward.

B of A analyst Mihir Bhatia even noted that filing the restated financials was "another step towards gaining approval" for the Capital One acquisition. It cleared a significant hurdle in the merger process, allowing both companies to move forward with more confidence.

Looking Ahead

As we’ve seen time and again in the financial world, shareholder approval is a crucial step, but it’s far from the final word. The regulatory gauntlet that lies ahead will ultimately shape the final form of this merger and its impact on the financial landscape.