Over the past week, led by

, fintech converged on NYC for an intense few days of networking and reconnection, community building, learning, and reflection. Fintech Compliance Chronicles was an active participant for a second straight year, including hosting and attending a number of events.The week kicked off at Rise, NYC’s Fintech Accelerator and Hub, with NYC Fintech Coffee. This is a monthly event that Rise has been hosting in partnership with Received and

for quite some time, but what made this bittersweet is that it will likely be one of the last times the event occurs (at least at Rise itself) as Rise is closing down at the end of May - a sad development for me personally as I was a member for two years. The event was boosted by the presence of folks from out of town, and I’m certainly grateful to have linked up with many of you there.On Tuesday the day was insanely packed - kicking off with our very own “Compliance & Pastries” breakfast event, which brought together ~ 20 founders, legal folks, compliance pros, and others from across the country. It was a privilege to be able to host such smart and way-cooler-than-me people for a second straight year during this special week (this time while actually having a voice!). For me personally, the impact of these get togethers is measured by how many friends from last year joined us again for this year’s edition. And this year, it was extra special joining forces with Dmitry Gritskevich of ComplyCo to host an event during this week. Kudos to the staff at The Smith - Nomad for providing great food, service and a cool venue in the heart of Midtown.

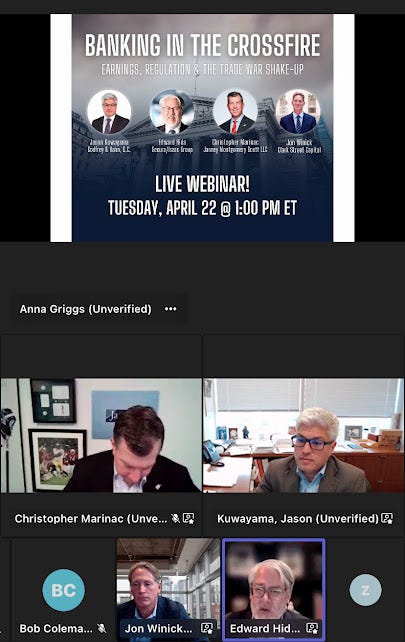

Then during lunch, I joined in a virtual webinar which featured one of my favorite people, fellow Ascend Executive Network member Edward Hida and Senior Executive Advisor as Secura/Isaac Group, entitled “Banking in the Crossfire: Earnings, Regulation and the Trade War Shakeup”.

Some of the takeaways of the event:

Investor sentiment is heavily influenced by ongoing uncertainty - stemming from trade wars, tariffs, and shifting regulatory and political environments. This uncertainty is reflected in cautious bank outlooks and market volatility.

Credit losses and charge-offs remain historically low, with only slight increases in certain consumer segments like credit cards. Banks have ample reserves and strong pre-tax, pre-provision revenue (PPNR), providing a cushion against potential credit deterioration

The new administration is rolling back or pausing some regulatory initiatives, including higher capital standards and certain merger rules. M&A deal approvals have accelerated, and the regulatory environment is expected to become less burdensome, especially for smaller banks

The CFPB is shifting focus to tangible consumer harm and passing more enforcement responsibility to states. CRA (Community Reinvestment Act) rules are reverting to pre-2020 standards, reducing compliance complexity for banks

Significant layoffs at the CFPB and FDIC are not expected to materially impact bank examinations or deal approvals, given the agencies’ previous staffing levels

Recent policy changes-such as the resumption of student loan collections and stricter enforcement on delinquent mortgages-are expected to increase financial pressure on consumers, potentially leading to higher delinquencies in the coming quarters

While large regional bank mergers are expected to pick up in 2026–2027, small bank consolidation continues at a steady pace, aided by faster regulatory approvals. Stock price volatility and uncertainty are temporarily slowing deal flow, but the long-term trend remains toward consolidation

The panel discussed ongoing political pressure on the Federal Reserve but expect its independence to be maintained. Most anticipate one rate cut in 2025, with further cuts possible in 2026, depending on economic conditions

With Michelle Bowman’s expected confirmation as head of supervision, further tailoring of regulations for smaller and mid-sized banks is anticipated

You can view the full session on YouTube here.

I then hiked up near Grand Central, to the American Australian Association to see my former Google colleague Pedro Morales - who is the Global Head of AML/Sanctions Compliance and Payments Compliance - and several other regulatory/compliance leaders share Global Perspectives on Tomorrow’s Regulatory Compliance, organized by Fivecast. The panel also included Shawna Klatt, Senior Legal Customer Success, Thomson Reuters as the Moderator, Chad Longo, Director, Financial Crime Channels, Fivecast, Síobháine Slevin, CEO, Realta Logic and Sebastian Gonzalez, Chief Business Officer Americas, Roboyo.

This was one of those rare sessions where the panel not only jived but you actually wished they could keep talking and providing super valuable insights on all things regulation and compliance. Indeed, topics discussed ranged from the US deregulatory stance being dwarfed by regulation globally continuing to scale unabated, the value of RPA tools, transparency of algorithms, the value of centralizing sources of knowledge in the identity verification process, and more.

Some of the key takeaways, put in the simplest way possible:

Compliance can help make money and is a differentiator

Filter the noise

Compliance is not your ex!

Lean into the change/be innovative

When in doubt, safe design will get you to compliance

The day ended with me swinging back near Battery Park, joining in a happy hour led by two of my favorite founders in the space, Faraz Rana of Affinity and Kalyani Ramadurgam of Kobalt Labs, along with Scale LLP. Although I couldn’t stay long, it was a great way to end the day by talking shop and connecting with founders who are making some seriously cool innovations in the RegTech area.

On Wednesday, I walked over to the Washington Square area to Aleo’s office to join in the Financial Club’s lunch and learn networking session on AI, featuring Oivind Lorentzen, Partner at Oak HC/FT and Sam Bobley, Co-founder & CEO at Ocrolus. While this wasn’t a compliance-heavy event per se, it was great to meet with fellow AI enthusiasts and learn about how AI has become a core consideration from an investment and operational perspective. We were blessed with great conversations, great food, and most notably, a great rooftop view:

Finally, on Thursday we closed out the week where we began, with a farewell party for current and past members of Rise. It was nice to take a final walk through the halls which have meant so much to me over the years, and connecting with folks familiar and new. Plus enjoying some custom-made tacos, some sweet coconut purple dumplings, and juices. A few parting shots from the place I have called a second home for the last few years:

That’s all for this year - a special shoutout to my friend

, the mind behind this epic week that has become can’t-miss for anyone in the fintech world, for all he does for the community. Stay tuned as we plan our next in-person get-together coming in June during NY Tech Week!